Jean Monnet Chair in EU External Economic Relations

Service Navigation

"Lecture and discussion" with Theocharis Grigoriadis

On July 10, 2024 at 4:00 p.m., Prof. Dr. Theocharis Grigoriadis will give a lecture on the topic "War and Peace in Eurasia: Ukraine and the Economic Future of Europe".

Russia's war in Ukraine has changed the financial and security environment in the European Union and Eurasia. Scenarios of war and peace in Ukraine will be analyzed with regard to their impact on the country's development and suggestions for a European strategy in this conflict will be made.

The event will be held in German.

Free admission!

Time & Place

July 10, 2024 | 4:00 p.m. - 5:00 p.m.

Library of Economics at the Free University of Berlin

Research Seminar in Economics University of Crete

June 27, 2024: Daphne Nicolitsas (University of Crete)

Should those who do not wish to study enter higher education?

Abstract:

The number of students entering higher education has been increasing for a very long time in Greece. An extension in demand for higher education was met with an increased supply of student places. As a result, the threshold for university entry did not increase. High-school students graduating in June 2021, however, faced for the first time a threshold to entering University. This has prompted a public discussion on whether admissions to and progression within universities on academic grounds should be stricter. The main point argued here is that entering University despite previous low academic performance does not typically bode well with meeting university academic standards, and thus, students take a very long time to graduate if they do. In this paper, we first document the extent to which degree completion takes much longer than the minimum required and report on the number of times students resit exams. Second, we investigate whether a policy, announced in 2007 and explicitly abolished in 2010, setting an upper limit to the number of times students can retake exams to prevent students from staying on at universities, had an impact on resits despite the fact that the policy was not enforced. Third, we estimate the sensitivity of the degree. That is, we estimate the percentage of false negatives under the assumption that if a student takes a test on one of the compulsory courses five times or more, then the student should not graduate. Finally, we estimate the extent to which students' poor academic performance could have been foreseen based on their diligence during their university studies, their grades in high school and their preferences for the study subject.

Time and Location: 12.15–1.30 p.m. On-site: 202 Sitzungsraum / Kaminzimmer Boltzmannstr. 16-20 14195 Berlin-Dahlem

Research Seminar in Economics Dimitrios Zormpas University of Crete

May 2, 2024: Dimitrios Zormpas (University of Crete)

Strategic capacity investment with overlapping ownership

Abstract

We study how common ownership affects the magnitude and dynamics of investments in a duopoly. The timing and quantity reactions of followers are less aggressive because they internalize their effects on leaders. Leaders therefore act more aggressively and are more likely to opt for a deterrence strategy, though internalization of followers softens their decisions also. If firm roles are exogenous, higher common ownership links ultimately lead to an efficient outcome involving staged investments. If firm roles are endogenous higher common ownership eventually drives the winner of the preemption race to take a toehold so as to concede a monopoly position to the follower. In all cases our numerical analysis finds that common ownership is detrimental to consumer surplus and welfare.

Time and Location: 12.15–1.30 p.m. On-site: 202 Sitzungsraum / Kaminzimmer Boltzmannstr. 16-20 14195 Berlin-Dahlem

Research Seminar in Economics American University of Beirut

February 08, 2024: Nadine Yamout (American University of Beirut)

Dutch Disease, Unemployment and Structural Change

Abstract

We build a multi-sector, open economy model that captures the effects of a commodity boom on unemployment when there is also ongoing structural change. We use Bayesian methods to jointly estimate transition path effects of structural change and business cycle dynamics. Applying our model to the Australian economy, the estimates suggest that the large, permanent increase in commodity prices of the 2000s is critical for the observed appreciation of the real exchange rate and the contraction of net exports. Consistent with Dutch disease, the commodity boom increases unemployment in the short run. But structural change in the form of shifting preferences over non-tradable consumption and non-tradable employment, a process somewhat akin to structural transformation, explains the long-run reduction in unemployment, the increasing importance of the non-tradable sector for aggregate fluctuations and the increasing responsiveness of the tradable sector to shocks.

Time and Location: 12.15–1.30 p.m. On-site: 202 Sitzungsraum / Kaminzimmer Boltzmannstr. 16-20 14195 Berlin-Dahlem

Research Seminar in Economics University of Helsinki

December 07, 2023: Andrei Markevich (University of Helsinki)

Social Mobility in Times of Revolutions and Regime Changes. Persistence of Elites in 20th Century Russia

Abstract

How much do radical changes of social order affect the persistence of elites? To address this question, we analyze the impact of the 1917 Russian revolution, measuring the spread of Tsarist elite surnames among Soviet and modern Russian elites. We document a quicker decline of elite representation at the start of the Soviet era, but mostly for military outcomes during Stalin’s reign. Over the longer haul (1914-2022) we find that, despite a series of post-revolutionary shocks during the 20th century, elite persistence was surprisingly large and very similar for elites from different backgrounds. However, the persistence rate of 0.5 is smaller than the multi-generational estimates Gregory Clark finds for other countries (0.7-0.8).

Time and Location: 12.15–1.30 p.m. On-site: 202 Sitzungsraum / Kaminzimmer Boltzmannstr. 16-20 14195 Berlin-Dahlem

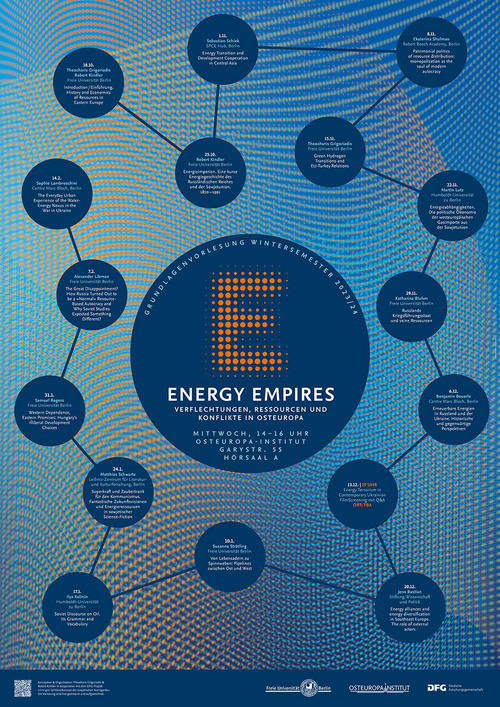

Sebastian Schiek talk: OEI introductory lectures "Energy Empires. Interdependencies, Resources and Conflicts in Eastern Europe"

Sebastian Schiek (SPCE Hub, Berlin):

Energy Transition and Development (Cooperation) in Central Asia

Winter term 2023/24

18.10.2023-14.02.2024

Wed 14:00-16:00

Garystr. 55 / Hörsaal A

The lecture "Energy Empires. Interdependencies, Resources and Conflicts in Eastern Europe" is dedicated to the history of energy, conflicts over energy production and use and the complex interdependency processes involved. Students and other interested parties will gain insights into historical developments, current challenges and geopolitical aspects associated with the topic of energy in Eastern Europe."

The lecture will be streamed live and recorded.

The complete program of this lecture series can be found here.

The South Caucasus and the European Union: From Conflict to Cooperation

Silberlaube, L23 0.3099, Fabeckstraße 25, 14195 Berlin

The OEI of Freie Universität Berlin presents an exciting panel discussion on the relations between the South Caucasus and the European Union. Moderated by Theocharis Grigoriadis and Ira Beridze. Look forward to valuable insights and a delicious gastronomic experience with Georgian food!

Join us and don't miss these insightful events! For more information, please visit our website and the official LNDWBerlin website.

Research Seminar in Economics American University of Beirut

July 06, 2023: Sumru Altug (American University of Beirut)

Investment under Stormy Skies: The Case of Russian Firm during 2004-2016

In this study, we quantify the effects of uncertainty on investment decisions for the Russian economy. We employ an empirical specification where the dynamics of investment under uncertainty are captured by an error correction model of investment. We use a rich panel of Russian non-financial firms which is uniquely suited to studying investment in Russia over the period 2004-2016. We treat the sanctions regime instituted in 2014 against entities in Russia as a quasi-natural experiment. To control for the heterogeneous effects of the ruble devaluation and oil price decline that occurred concurrently with the sanctions regime, we exploit firm-level and sectoral variation in our micro level data set that covers both large firms and SMEs. We find significant negative effects of uncertainty on the response of investment to demand shocks due to the sanctions regime after isolating the effects of foreign exchange exposure that works through balance sheet channel of the ruble devaluation, the effects of the oil-cost dependence in production as well as of the indirect effects of trade linkages with sanctioning countries on the investment rate.

Time and Location: 12.15–1.30 p.m. On-site: 202 Sitzungsraum / Kaminzimmer Boltzmannstr. 16-20 14195 Berlin-Dahlem